29+ calculating dti for mortgage

Ad See how much house you can afford. 1 Add up the amount you pay each month for debt and recurring financial obligations such as credit cards car.

How To Calculate Your Debt To Income Dti Ratio Chime

Web Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you money.

. Get an idea of your estimated payments or loan possibilities. Web Lets look at a real-world example. Web Calculating your DTI ratio.

Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount. Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. Take Advantage And Lock In A Great Rate.

Take Advantage And Lock In A Great Rate. Web Calculating a 25 DTI Monthly Social Security Income taken at 125. Youll just need to add up your total monthly debt payments and divide it by your total gross monthly.

Use NerdWallet Reviews To Research Lenders. Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680. Web Your front-end or household ratio would be 1800 7000 026 or 26.

Web How to Calculate Debt-to-Income DTI Ratios - Mortgage Math NMLS Test Tips MortgageEducators 144K subscribers 469 39K views 2 years ago In this video you will. Ad Learn More About Mortgage Preapproval. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

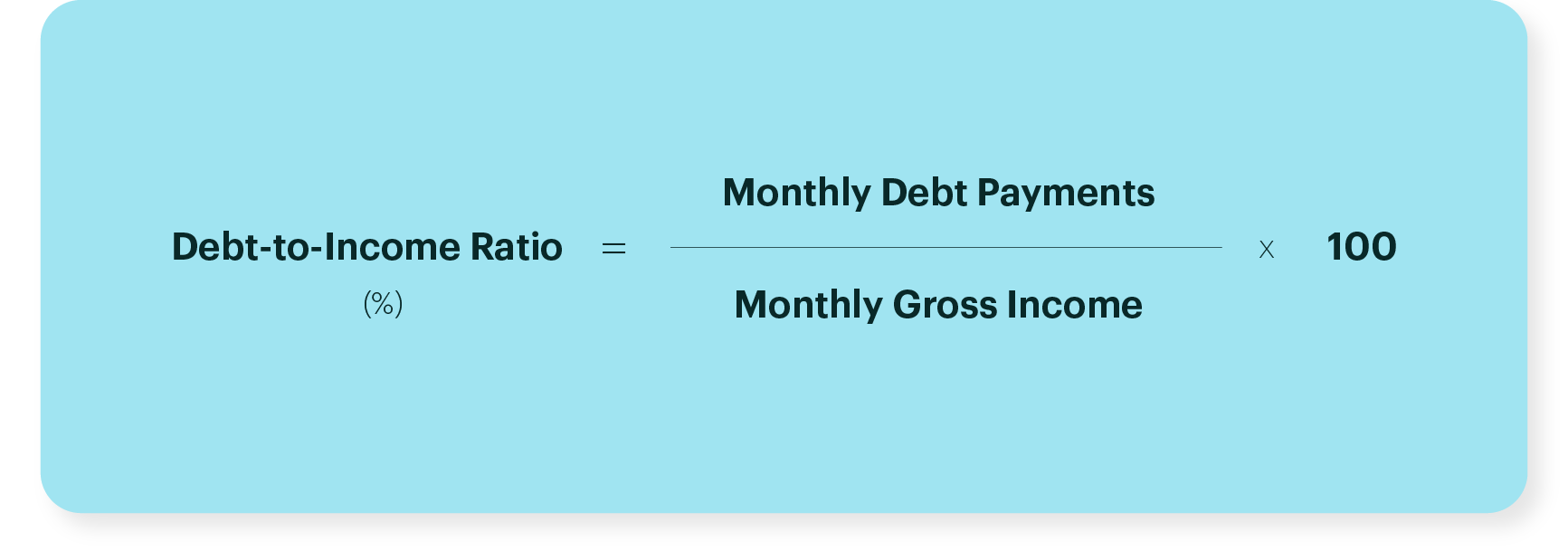

Web The formula for calculating your DTI is actually pretty simple. If John is able to both reduce his monthly debt payments to 1500 and increase his gross. Web Lenders calculate your debt-to-income ratio by using these steps.

500 Monthly housing payment. Estimate your monthly mortgage payment. 130 minimum monthly payment.

Browse Information at NerdWallet. Ad Learn More About Mortgage Preapproval. Use NerdWallet Reviews To Research Lenders.

Heres how lenders typically view DTI. Start by adding up all the debt payments you make in a month including student loans car payments credit card bills alimony child. Browse Information at NerdWallet.

Web Johns DTI ratio would be calculated as 1500 6000 025 or 25. To get the back-end ratio add up your other debts along with your housing. Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments child support.

6000 Monthly recurring debts. Try our mortgage calculator. Web For example if you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt.

How To Calculate Debt To Income Ratio For Mortgage Loan Simple Calculation Youtube

How To Lower Your Mortgage Debt To Income Ratio Dti Better Mortgage

How To Calculate Income Calculating Income Mortgage Math Nmls Test Tips Youtube

How To Calculate Your Debt To Income Ratio Rocket Money

What Is Dti And How Does It Affect Your Mortgage Eligibility A D Mortgage Llc

How To Lower Your Dti Ratio

What Is A Good Debt To Income Ratio Better Mortgage

Dti More Important Than Your Credit Score Newrez

How To Use And Calculate Debt To Income Ratio Smartasset

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Understanding Debt To Income Ratio When Buying A Home

How Your Debt To Income Ratio Can Affect Your Mortgage

Debt To Income Ratio Dti Ratio Formula Idfc First Bank

Debt To Income Dti Ratio Requirements For A Mortgage

Debt To Income Ratio Calculator Nerdwallet

How To Calculate Your Debt To Income Ratio Rocket Money

Debt Ratio Formula Calculator With Excel Template